Democrats on the Joint Select Committee on Deficit Reduction last week floated a proposal that includes massive tax increases on wealthy Americans. While their plan would also include some cuts to entitlement programs, the tax-code changes make up a significant portion, according to press reports.

The Los Angeles Times reported: “Revenue would be raised mostly by bumping up the high-end tax bracket and limiting deductions for upper-income earners, those familiar with the talks said.”

This isn’t exactly a surprise. President Obama and his liberal allies in Congress are waging a war against successful Americans. House Budget Chairman Paul Ryan (R-WI) spoke at Heritage last week about the divisive nature of Obama’s scheme.

The so-called Super Committee, of course, could be an opportunity for Congress to reform the tax code. Writing in the Washington Times last week, Heritage’s J.D. Foster observed:

But if tax reform is part of a deficit-reduction exercise because the language of tax reform has been co-opted to disguise a tax hike, then both the hike and the reform should and likely will fail. Be very clear — tax reform is revenue neutral as traditionally scored. If a tax proposal is shown to raise revenue, then it’s not tax reform, it’s just another big-government tax hike.

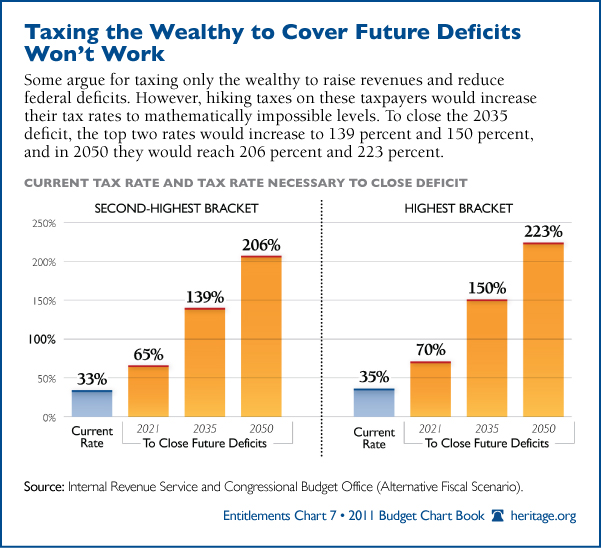

As for that proposal floated by Democrats this week, it’s simply not a viable solution. This chart from Heritage’s 2001 Budget Chart Book reveals that Congress would need to increase tax rates on wealthy Americans to mathematically impossible levels to close future deficits.

Source material can be found at this site.