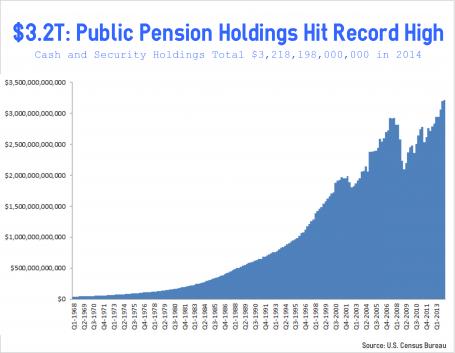

(CNSNews.com) – Public pension holdings and investments for the nation’s 100 largest public-employee pension systems hit a record high of $3.2 trillion ($3,218,198,000,000) in the first quarter of 2014, a 0.5 percent increase from $3,200.8 billion in the prior quarter, according to data from the U.S. Census Bureau.

At the same time, benefit payments totaled $62.9 billion in the first quarter, increasing 4.5 percent from $60.2 billion in the prior quarter. The year-to-year increase in payouts was 5.4 percent.

There is growing concern that as baby boomers age, benefit payouts will continue to increase faster than pension assets grow, leading to funding shortfalls.

“Liabilities are the future payments pensions must make to current and retired workers,” said Rachel Greszler, a senior policy analyst in with the Heritage Foundation. “Unfortunately, liabilities have increased faster than assets for quite some time now, leading to funding shortfalls.”

Greszler said the “real story” is the “massive size” of unfunded liabilities in public pensions.

“Although official estimates put those unfunded liabilities at or just under $1 trillion, more appropriate accounting methods show the true liabilities exceed $3 trillion dollars.

“Paying promised benefits to state and local retired workers will require massive tax increases or benefit cuts,” Genszler said. “Detroit’s bankruptcy, along with other municipalities across the country, demonstrates the effect that unfunded pensions have on cities’ finances and economic vitality.”

The General Accountability Office reported in 2012 that most large state and local government pension plans have assets sufficient to cover benefit payments to retirees for a decade or more. But the GAO also noted that these pension plans still face challenges over the long term due to the gap between assets and liabilities.

GAO said that “many states” are reforming their public pension systems, by reducing benefits and/or increasing member contributions.

Taking a closer look at the first-quarter numbers from the Census Bureau:

Cash and security holdings of public pensions totaled $3.2 trillion ($3,218,198,000,000) in the first quarter of 2014. The Census defines cash and security holdings as “cash, deposits, government securities, bonds, stocks, etc., accumulated by a pension fund for the purpose of meeting retirement benefits when they become due.”

Investment income is a key element of pension funding. The Census data shows that in the first quarter of 2014, earnings on investments totaled $73.2 billion, far less than the $165.7 billion investment return in the fourth quarter of 2013.

To be counted in the survey, public-employee retirement systems must meet two criteria: (1) they are sponsored by a recognized unit of government as defined by the Census Bureau; and (2) their membership must be comprised of public employees compensated with public funds. These retirement systems consist of traditional defined benefit plans, not defined contribution plans, such as 401(k)s.

The Quarterly Survey of Public Pensions (QSPP) provides national summary data on the revenues, expenditures, and composition of assets of the largest defined benefit public employee retirement systems for state and local governments.

The survey consists of a panel of 100 retirement systems, which comprise 89.4 percent of financial activity among such entities.”