The Bipartisan Policy Center’s (BPC) Debt Reduction Task Force – a highly diverse group of private individuals – has laid out a comprehensive approach to closing the deficit and slowing the rise in national debt.

They do this through a combination of spending reductions, many though not all of which are excellent and transformational (about 53%) and tax increases, all of which are ill-advised (about 47%). The report’s near silence on Obamacare is noteworthy and unfortunate even to the exclusion of the universally abhorred CLASS Act. Their cuts to defense stand in stark contrast to the first obligation of Government to provide a strong defense of the nation.

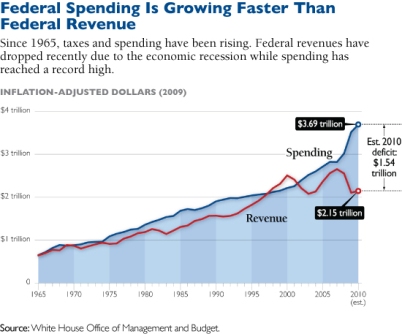

The plan they lay out, along with the recently released Bowles-Simpson mark, and Rep. Paul Ryan’s (R-WI) Roadmap, is yet another attempt to change the calamitous course the federal budget is on today. Kudos to the Task Force Members for furthering the discussion through hard choices, a discussion which should take place in Washington and across the nation over how big our federal government should be, what we expect from it and what we want our taxes to look like.

Transformational:

Most noteworthy, the Task Force has a striking proposal for Medicare to transition to a premium support program. This transformative change would empower Medicare patients with control over both dollars and medical decisions and result in more efficient delivery of quality care than the current system. They would also place strong limits on federal health spending ensuring that Medicare will be an affordable and sustainable program.

Good:

- Freeze and cap discretionary spending – here they could have gone further with actual cuts, though they include an important enforcement mechanism.

- Cut spending on farm subsidies, but again the cuts were too timid.

- Their tax plan sharply reduces top income tax rates and moves from six marginal rates to two. They also repeal the Alternative Minimum Tax. They also lower the corporate income tax rate and phase out the exclusion of employer-provided health insurance.

- Strong budget controls, including discretionary spending caps and putting entitlements on explicit long-term budgets.

Lost Opportunity

- On Social Security, they have very modest reforms to Social Security’s finances such as indexing the retirement age for future changes in longevity, reforming the COLA mechanism, slightly moving to more progressive benefits and strengthening benefits for lower income workers. Except for the COLA change, all of their proposed reforms should go much further. Unfortunately, their changes really come about from raising the amount of income subject to payroll taxes to $180,000, which is neither wise nor necessary. This is lost opportunity for strong reforms to fix and improve the program.

Bad

- Like Bowles-Simpson, their tax reform plan is a Trojan horse for large tax hikes through the elimination of nearly all tax expenditures. Moreover, this tax plan contains a large explicit tax hike in the form of a Deficit Reduction Sales Tax at 6.5% that will apply to approximately 75% of personal consumption expenditures including such things as sales of new homes, privately funded healthcare costs, and food. Though the authors of the report take great pains to avoid the term, in reality this is a value added tax, or VAT which, as an additional tax, will not increase national savings or promote stronger growth and be a permanent cash cow for Washington.

- Also, like Bowles-Simpson, they propose cuts to the defense budget. This approach asks the wrong question (How can we cut defense?) instead of the right one: What is required to protect the nation? Defense spending should be made as efficient and cost effective as possible, but savings must be reinvested in defense to make-up for a decade-long hiatus in properly modernizing the force. Cuts to defense now will lead to a hollow and humiliated military much like we had after Vietnam—and rebuilding the military would prove even more costly than maintaining it. Instead, the country needs to provide for defense an average of $720 billion per year (to be adjusted for inflation) for each of the next five fiscal years.

Building the conversation

The Domenici-Rivlin report is the kind of big picture radical approach that needs to be discussed with the American people, as must Congressman Paul Ryan’s plan and the left’s big plan – that is whenever they are willing to discuss their long-term agenda with the public.

Source material can be found at this site.