Under the law, Americans must be insured starting in 2014 or pay a penalty assessed on their tax returns.

Shortly after the legislation passed in 2010, the Congressional Budget Office, working alongside the Joint Committee on Taxation, estimated that in 2016 roughly six million people a year would opt to pay the penalty instead of getting coverage. On Wednesday, the CBO and JCT revised that figure up to eight million, citing legislation passed since 2010 as well as the weaker economic outlook.

The groups also pointed to the Supreme Court’s decision earlier this year to make the health care law’s expansion of Medicaid optional for states.

Of those people who opt for the penalty, 10% are projected to be below the federal poverty level for 2016, which the CBO and JCT estimate will stand at about $12,000 for an individual or $24,600 for a family of four.

In 2014, the penalty will be no more than $285 per family, or 1% of income, whichever is greater. In 2015, the cap rises to $975, or 2% of income. And by 2016, it reaches $2,085 per family, or 2.5% of income, whichever is greater.

The dollar amounts for a single adult would be $95, $325 and $695 during that same time period.

Roughly 30 million non-elderly Americans are projected to remain uninsured in 2016, though most will not be subject to the penalty tax. For instance, the penalty will be waived for people with very low incomes who don’t have to file tax returns, those who are members of certain religious groups, or people who face insurance premiums that would exceed 8% of family income even after including employer contributions and federal subsidies.

Penalty payments collected in 2016 are expected to total $7 billion, about $3 billion more than previously estimated.

The broken pledge to not raise any taxes on themiddle class from Obama is all but an old forgoton thought, Obama said in 2008.

Quote:

“I can make a firm pledge: Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes,not any of your taxes.”

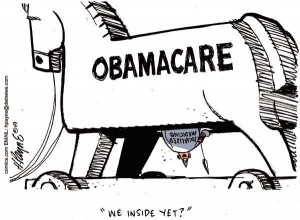

With every passing day, more evidence mounts that Obamacare is a costly disaster. We are not informed that even more of the middle class families who President Obama promised would see no tax increase, will in fact see a massive tax increase thanks to Obamacare.

Obamacare raids $716 Billion from almost-insolvent Medicare to chip in toward its own $2 trillion price tag, raises premiums on average families, increases national healthcare spending faster than doing nothing would have, swells the deficit, exacerbates the national doctor shortage, is insanely costly and difficult to comply with, and raises taxes by $500 Billion on the backs of millions of middle class families — and the country will still have 30 million people lacking health insurance.