The mortgage industry has been crying foul over rates going up a .25 % or 3/8thover the last month.

Well hang on, rates are headed to 5%!

No they aren’t, Oh Yes they are!

Think of things this way, they are buying $45 billion a month and the total cut for the year from sequestration was $85 billion.

The Quantitative Easing and Monetary Policy of buying 85 billion a month in MBS must stop and it will stop very soon!

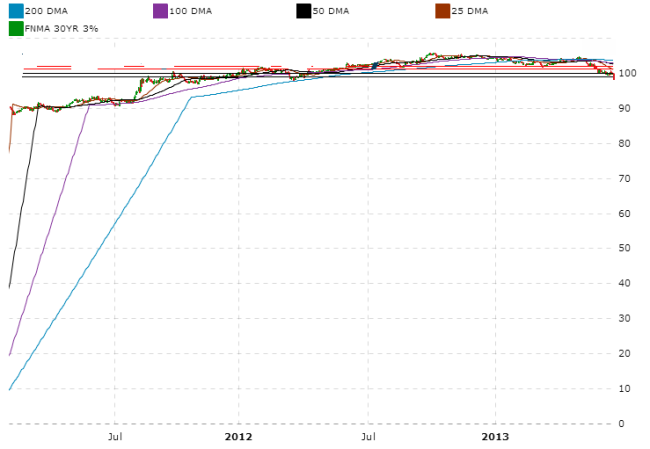

Today on the 30 year FNMA 3% MBS CHARTS- Our gauge for retail rates, we saw a sharp decline of 160bps based on the FED Talks of tapering.

Looking at the chart below- we must go beyond a 2 year history to find the next level of support. Where is this level of support? We closed today on the latter chart at around 98.6. We opened above 100.

The next LONG TERM level of support is not until 90 on the charts or almost a 1000bps worse than presently.

As we continue the trajectory downwards the 1000bps decline will correlate the 1000bps into an entire 1 point or 1% for retail mortgage prices.

If par is 4% once we factor in the decline that we will see, the rates will head to 5%.

As tapering talks continue, we saw a 500bps decline in just one week in May 2013.

We are in the middle of June. The soonest the tapering will begin is around the September 18th 2013 FED meetings. As Bernanke was publicly fired to some extent, by President Obama, and Janet Yellen is lurking in the shadows as big Ben’s replacement, rates at 5% are coming faster than people think.

There is nothing we can do but buckle down and hit the pavement and enjoy this roller coaster ride ahead of us.

There is virtually no support until rates creep up to 5%. Only support will be a big equities pull back with an inverse relationship to the MBS and Treasury’s, however there will be no inverse relationship until MBS finds a footing in relation to taper talks.