If there’s been one consistent thing about the Obama economic record, it’s that it’s wildly inconsistent. There have been many quarters of tepid growth, but also plenty of combinations in which we’ll see a huge drop followed by a huge jump, or vice versa.

And if expectations for tomorrow’s announcement of First Quarter 2015 growth are correct we may be headed for that scenario again.

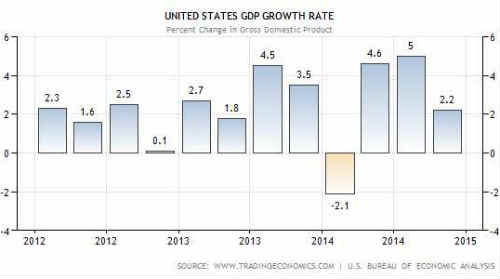

Check the last three years’ worth of growth trends on this chart from TradingEconomics.com:

Growth has been all over the place. You get your occasional strong-looking quarter, but it never leads to a positive trend. And forecasters don’t think we’re going into one now either:

Forecasters are in near-universal agreement that the government will report a slowdown in U.S. economic growth in the “advance” GDP report for the first quarter that’s scheduled for release on Wednesday (April 29). The only mystery is the degree of deceleration.

Optimism, at the moment, is defined by The Capital Spectator’s median estimate: a 1.8% increase for Q1 GDP (real seasonally adjusted annual rate), which represents a decline from the modest 2.2% gain in 2014’s Q4, according to the Bureau of Economic Analysis (BEA). In the meantime, today’s revised estimate is moderately below last month’s 2.1% outlook for Q1. Otherwise, it’s all downhill from here when we turn to other sources.

Most economists are expecting a lesser gain for Wednesday’s report. The Wall Street Journal‘s latest survey anticipates a tepid 1.4% rise for Q1. Econoday.com’s consensus forecast trims the expected gain to 1.0%. The Atlanta Fed’s GDPNow data pares the outlook to an incremental increase of just 0.1%. There’s even a touch of red ink for one of The Capital Spectator’s estimates that’s used to calculate the median forecast (see table below). The bottom line: If Wednesday’s report reveals that Q2’s growth rate held steady or accelerated, the news will come as surprise to almost everyone.

This could all be wrong, of course. We could get one or those “better than expected” reports tomorrow morning. (Then again, it could be revised downward a month or two later as often happens). But if we follow the pattern of the Obama economic record, which is never-ending fits and stops, another dud quarter is exactly what we’ll get. It’s the best you’re ever going to get when the federal government is hostile to wealth creation and capital formation. Sometimes the private sector can get it in gear and overcome the roadblocks the government puts up, but they can never do it consistently. Only economic policies that are friendly to wealth can allow that to happen.

And we’re not going to get that until at least January 2017, and then only if the electorate doesn’t make an even bigger mistake than the one it’s made the last two times.