Lowering the corporate tax rate will spur economic growth and encourage business owners to invest more in their businesses, leading to higher wages for employees, according to a new report from the president’s Council of Economic Advisers.

The report on tax reform, released Friday, focuses on the expected results of decreasing the corporate tax rate from 35 percent to 20 percent, such as Americans seeing an increase of $4,000 in annual income.

By the Council of Economic Advisers’ calculations, such a reduction in the corporate tax rate would produce an annual increase of 3 percent to 5 percent in gross domestic product. It also would result in higher pay and increased productivity from employees, the council predicts:

In this indirect channel, changes in the corporate tax rate affect the investment decisions of firms; lower tax rates encourage investment and produce a higher ratio of capital to labor. The higher ratio of capital to labor then generates productivity increases for workers and raises their wages.

President Donald Trump and Republicans in Congress are focused on passing tax reform after multiple failed attempts at repealing and replacing Obamacare earlier this year.

The House voted 216-212 Thursday for a $4 trillion budget, a slim margin that allows Republicans to begin work on a $1.5 trillion in tax cuts without fear of Democrats’ blocking tactics, the Associated Press reported. None of 192 Democrats voted yes, and 20 Republicans voted no.

The Council of Economic Advisers, a White House agency that advises the president, calls for a reduction in the corporate income tax rate and “a move toward immediate full expensing for capital investments, excluding structures.” The report is the second in a series exploring the impact for American workers of those two key elements of Republicans’ plan for business tax reform.

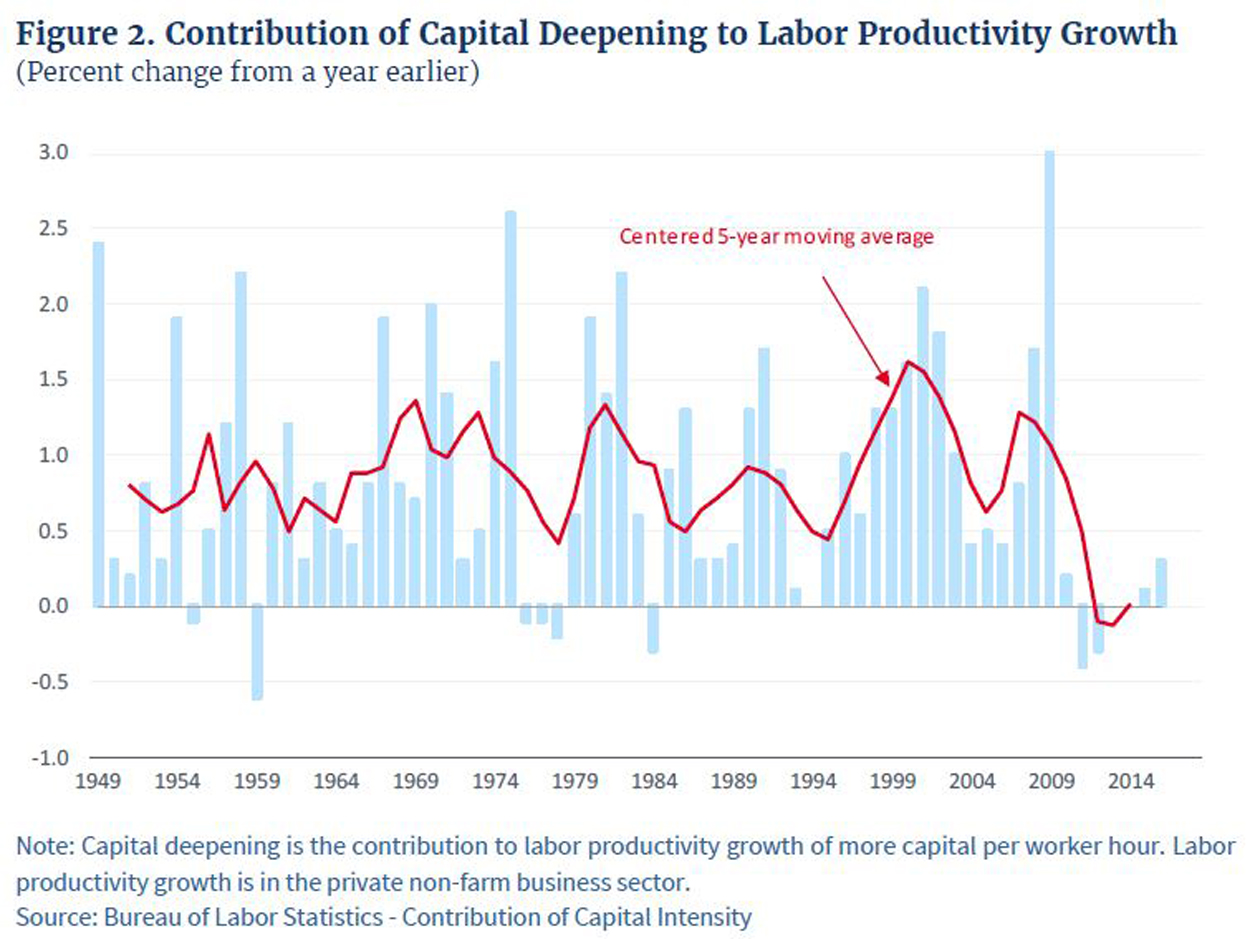

The council’s paper includes a chart of the nonfarm business sector of the economy, which it says “captures 75 percent of total economic activity.”

The chart shows how “capital deepening,” or investing more money in the business, contributes to more productivity. Because of “weak capital investment,” the paper says, growth in labor productivity hasn’t budged since 2011.

This chart from the Council of Economic Advisers report shows the five-year stagnation of growth in labor productivity.

“The headline is that for the first time in recorded history going all the way back to ’49, the contribution of capital deepening to labor productivity growth went negative, and if you’re wondering why wage growth has done so awfully in the presence of profit growth … the answer is that there’s no capital deepening to support productivity, to support wage growth,” Kevin Hassett, the council’s chairman, said.

Hassett, sworn in Sept. 13, previously was director of domestic policy research at the Washington-based American Enterprise Institute, a conservative think tank where he also directed economic policy studies for more than 10 years.

Returning to the “historic, long-run level of capital deepening” would boost employee productivity by 0.8 percent each year, the council’s paper says.

It adds that “if these productivity gains are translated to worker wages,” nonfarm workers could see their yearly income increase by $4,000 over eight years.

U.S. companies that hold their profits overseas reduce wages for workers at home, the paper says. Companies do this “at the expense of domestic investment” because of lower tax rates in other nations, but also send back less in profits:

Under the assumption that U.S. workers would retain 30 percent of the 2016 profits of U.S. firms earned abroad and not currently repatriated, U.S. households could earn a raise of up to 1 percent, depending on the share of profits repatriated.

Source material can be found at this site.