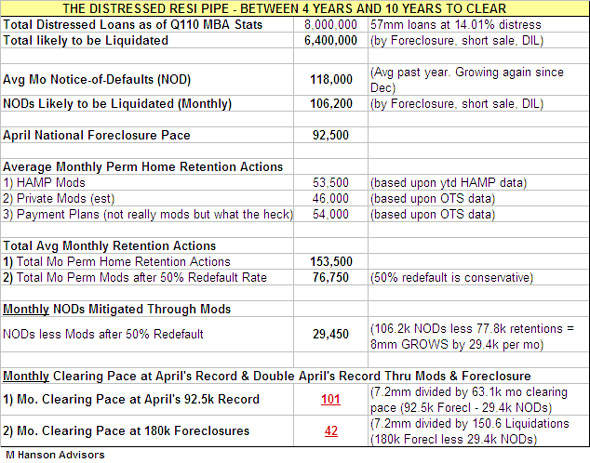

If monthly Foreclosures double (hypothetically) to 180k from April’s record 92.5k and stay at that level — based upon the 1) monthly average Notice-of-Default (NOD) 2) HAMP and private mortgage mod volume 3) and conservative cures and redefault rates — it will take 42 months to clear the portion of the 8mm loans presently in the distressed pipeline that will ultimately be liquidated. If Foreclosures remain at April’s record high of 92.5k, it will take 101 months.

With 900k record foreclosures in 2009 (but only 2.3mm since Jan 2007), 2.16mm (180k*12) needed every year for the next four years to purge the distress inventory plaguing and overhanging the market, and potentially fewer existing sales in 2010 than the 5.15 million in stimulus-driven 2009, it is easy to understand the challenge facing the housing market ex-stimulus.

I am a firm believer that the only way the housing market stands a chance of maintaining momentum post-tax credit is for Foreclosures to surge because they are what are in demand. In fact, over the past few months investor demand has waned due to the lack of Foreclosures and competition from swarms of first-timers waiving Obama coupons who they refuse to bid against. First timers, who are notorious for turning it off and on overnight, now make up some 50% of all sales according to the most recent Existing Home Sales report. That is a shaky foundation.

But surging Foreclosures — plus surging short sales in recent months — will significantly increase the distressed-to-organic sales ratio negatively impacting reported median and average house prices., which have benefited from a falling ratio over the past several months with distress sales as a percentage of total sales dropping every month in 2010.

But even at April’s 92.5k record Foreclosure pace — at a time when stimulus is ending, with sales volume set to fall and servicer’s assigning more Foreclosure resales to real estate brokers in April than in all of Q1 combined — prices stand to fall under considerable mix-shift pressure in the near-to-mid term.

At April’s Record Foreclosure Pace the Distressed Bubble Keeps Blowing

Massive-scale home retention (mortgage mod) programs have truly helped only a small slice but primarily served to slow up the pace at which foreclosures have occurred over the past year. This has created a giant bubble of distressed homeowners in the pipeline that over time will be liquidated. But in order to get through it the bubble has to quit expanding. Herein lies the challenge.

Based upon the past year’s average monthly Notices-of-Default, house retention and redefault figures taken from the MBA and OTS quarterly reports, and the Making Home Affordable monthly HAMP report, the number of loans being permanently modified each month is only 30% greater than receive an NOD each month. But after a conservative 50% redefault rate is applied to the retention actions and a 90% liquidation rate to the NOD’s, the number of NOD’s headed for liquidation outpaces retentions by 38%.

This means that the sum of all loan mod programs on the market today is not letting any air out of the massive distress loan (shadow inventory) bubble.

Findings

For the purposes of this report I assume that new permanent loan mods and new NODs stay flat going forward, despite over the past few months mods have been sharply declining and NODs rising.

In addition, I do not give the surge in short sales or the new Home Affordable Foreclosure Alternatives (HAFA) program any weighting because both are so new the results are unknowable. In addition, short sales are the ultimate in shadow inventory because they do not necessarily have to originate from the distress mortgage pipeline, therefore, do not subtract from it. Every homeowner with a first and/or second mortgage balance of 95% LTV (due to 6% Realtor fee) is a potential short-sale candidate. As short sales become the first-line liquidation method across all servicers, they will increase in volume from both current and non-current borrowers, perhaps keeping the shadow inventory liquidation time-line estimate in this report intact.

However, I am a big HAFA proponent and think it will be an overwhelming success. If I am correct, then the years of shadow inventory referred to in this report will be cleared somewhat quicker, but absolutely at the expense of the distress-to-organic sales ratio and reported median and average house prices. In fact, if prices get weak enough this actually could lead to increased delinquencies, defaults, and foreclosures none of which I account for either.

1) There are 8 million in the delinquent, default and foreclosure pipe per the most recent MBA report (14.01% of 57 million mortgages). Of these, 80%, or 6.4 million, should end up in liquidation.

2) On average over the past year 118k borrowers monthly have received an NOD. Ultimately, at least 90% of all NODs will end up with the borrower losing the house. (I use NODs in this report vs 30 or 60 day lates because once an NOD is filed few will cure naturally and a mod, Foreclosure or short sale is the most likely outcome).

3) Each month there are roughly 153.5k borrowers put into a home retention plan per the most recent OTS and Making Home Affordable reports. They consist of 53.5k HAMP Perm Mods, 46k Non-GSE Mods, and 54k Payment Plans, the latter of which are not technically a mod but I counted them anyway to be conservative. And remember two key points a) not every Mod or Payment plan has to involve a borrower in official default so the potential shadow universe is that much larger b) at least half of all mods will ultimately fail due to the average mod allowing too much DTI leverage, which I have covered on numerous occasions.

4) New monthly trial modifications are on a significant down slope — down about 50% from mid-year 2009 peak levels. For HAMP, April brought the fewest number of ‘mods offered’ and ‘trial mods started’ since the program rolled out, as some servicers began gearing up early for HAMP 2.0 beginning on June 1st for which borrowers have to qualify up-front vs. on stated income under which HAMP 1.0 has been operating since July 2009. Trial mods feed future perm mods. Without stated income mods, half qualify – what a surprise.

There is no evidence that mod starts will meaningfully increase unless the programs are made much easier, because servicers are running out of eligible victims, as evidenced by the ever-increasing perm mod back-end debt-to-income ratios allowed (64.3% median for HAMP in April), which I have also covered on numerous occasions. This increasing DTI will also lead to increased redefaults regardless of equity (or negative-equity) position.

Lastly, it is my opinion that the HAMP 2.0, which ushers in pseudo principal balance reductions earned over a three-year period down to 115% LTV, will not change the outcome much. Most analysis agrees that this will be a panacea. But based upon my years front-line mortgage experience and research, with the median debt-to-income ratio at 64.3%, the borrower at 115% or 150% are in the same boat…both are underwater, over-levered renters who can’t sell, re-buy, refi, spend, save, or vacation.

More than likely HAMP 2.0 will have the effect of forcing borderline borrowers, who would have otherwise found a way to make their payment, into default in order to take advantage of the program. If this is the case, these strategic defaulters — who will have a better redefault rate — in theory could raise the performance level of the program.

5) If the 8 million distress pool is filing at an average pace of 118k per month, of which 106.2k will ultimately be liquidated, and these are being mitigated through perm mods with an average pace 153.5k per month, or 76.8k per month after re-defaults, then the pool of 8mm distressed homeowners is a growing by 29.4k NOD’s per month. The 29.4k monthly increase is only reduced through Foreclosures, HAFA solutions, or traditional short sales or deeds-in-lieu.

Summary

6) When factoring in April’s 92.5k record Foreclosures (not including short sales), the distressed pool shrank by only 63.1k units (92.5k Foreclosures less 29.4k remaining NOD). At this pace, it will take 101 months to clear the pool of 6.4 million loans headed for liquidation. At a pace of 180k Foreclosures per month, twice April’s record high, it will take 42 months to clear the existing distressed inventory.

On the bright side, based upon the default and Foreclosure pipe action, which I track in real-time daily in aggregate and on an originator and servicer-specific basis, it seems that over the past few months the banks have regained a mind of their own. Unlike action I tracked as early as January 10 when all the big servicer’s NOD through Foreclosure charts looked the same, most have diverged.

In fact, two of the nation’s top four servicers, which I have highlighted in many client reports over the past few months, have opened the flood gates beginning in March. And the GSE’s, who led the Foreclosure charge higher beginning in Feb, are in property liquidation mode, which could force all the big GSE servicers to quickly follow suit on their own portfolios — none expected the GSE’s to blink first and do not want to get left in the liquidation dust.

Perhaps this is the first sign in almost two years of an efficient default and Foreclosure process poking its head out. Time will tell.