Fed to taper bond buying by $10 billion a month

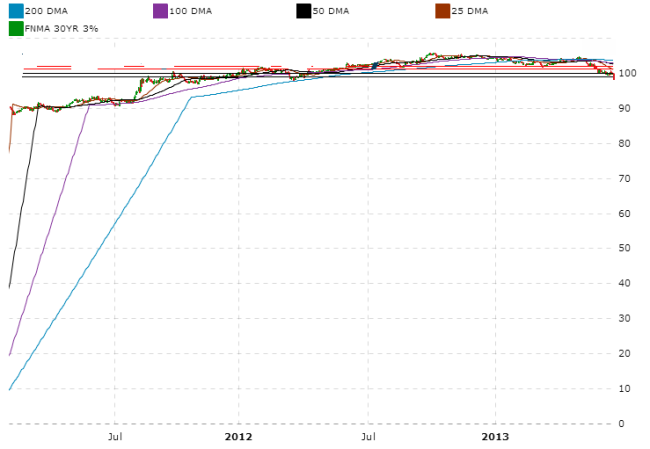

The Federal Reserve announced Wednesday it would start to taper its aggressive bond-buying program to $75 billion a month beginning in January, propelling the market to a record close. The FOMC also announced it would lower its monthly long-term Treasury bond purchases to $40 billion and mortgage-backed securities to $35 billion a month, both reductions […]