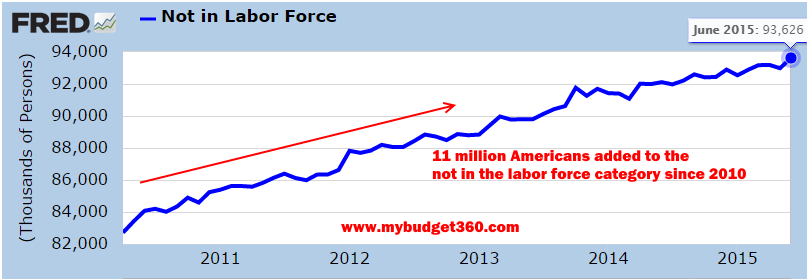

11 million Americans join the not in the labor force category

Even accounting for demographic changes, the not in the labor force category has grown much faster than anticipated. Since 2010 we have seen this category grow by 11 million people. If you are keeping track, the economic recovery started in the summer of 2009, six years ago. So is this really a jobless recovery? Not necessarily but we are certainly not adding enough jobs to keep up with population growth. Most of the jobs we are adding are in the form of low-wage labor jobs.

Just look at how quick the not in the labor force category has grown:

Last month alone we added a whopping 640,000 to this category, nearly three times the amount of jobs added. As more Americans are relying on Social Security as their primary source of retirement income, we need to keep the tax dollars flowing. Yet you have a younger and less affluent population. This is going to put larger strains on the Americans that are actually employed in the labor force.

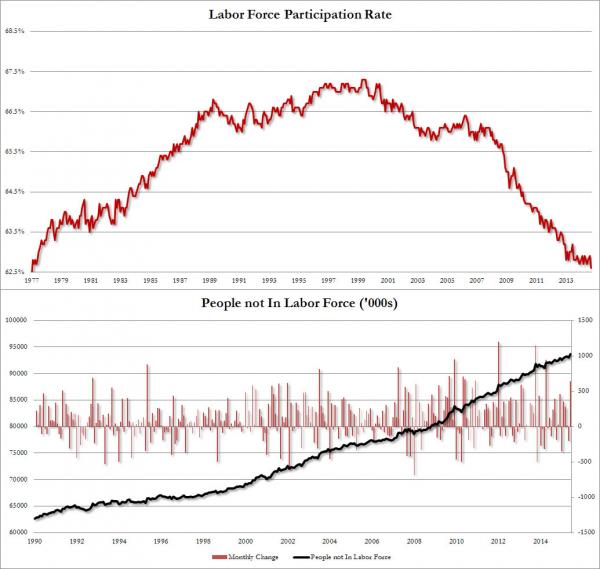

This is also a reason why our participation rate in the employment sector is near generational lows:

The last time the labor force participation rate was this low was back in the late 1970s. Why is this problematic? It would be one thing if all of these people were retirees with planned out portfolios and large nest eggs. Sadly, most are broke and fully relying on Social Security. Many others are on the new retirement plan of working until they die. So much for the financial planning propaganda of long walks on the beach and sipping margaritas until the old ticker gives out.

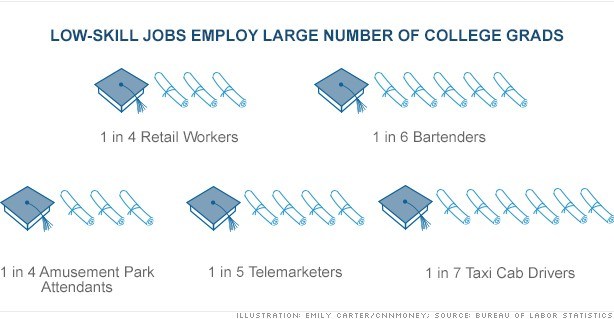

What we have right now is a case of demographic headwinds and a debt fueled economy. Every large purchase now needs to be financed with debt. Student debt is now at a jaw dropping $1.3 trillion. Most jobs that pay a decent living wage require some form of college education. Yet many people choose degrees that have little demand in the marketplace. That is how you end up with well educated and low paid workers:

“1 out of 4 retail and amusement park workers have a college degree. 1 in 6 bartenders has a college degree. And you wonder why so many Americans are having a tough time paying back their college debt. Of course this is for people that are working. Many young Americans are working part-time or not working at all in our massive “not in the labor force” category that is ignored.”

This is becoming a larger problem for the economy and will likely show up in the 2016 election campaigns. 93.6 million Americans that can work are not working for one reason or another and old age can’t explain all of it away.